When people talk about aging in place, the conversation usually starts with the mortgage. Once that payment is gone, the thinking goes, the house becomes affordable. In many cases that’s true — but it’s also incomplete. Property taxes don’t go away, and over time they can become one of the more unpredictable expenses for retirees.

I’ve reviewed household finances for people at every stage of life, and property taxes are one of the costs most often underestimated in retirement planning. Not because they are always large, but because they tend to change in ways people don’t expect.

Why Property Taxes Don’t Stay Put

Property taxes are set locally. They are based on what the county believes your home is worth and how much revenue local governments need to raise. School funding, infrastructure repairs, emergency services, and voter-approved measures all play a role.

What matters for retirees is that these factors are not tied to personal income. A homeowner’s budget may stay the same year to year, but property taxes can increase because the surrounding market changed or the county adjusted its rates. Those increases don’t happen smoothly. They often come in steps.

Someone might see little change for several years, then receive a reassessment notice that raises the taxable value of their home by a meaningful amount. On a working salary, that increase may be manageable. On a fixed income, it usually requires adjustment somewhere else.

The Income Side Often Moves More Slowly

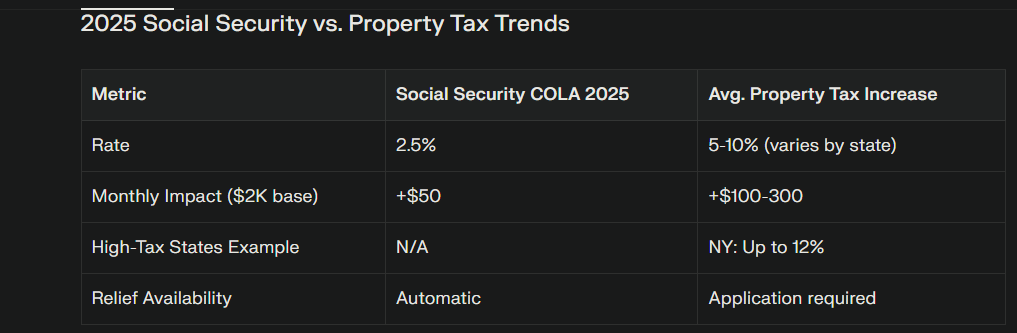

Social Security benefits adjust annually through cost-of-living increases, but those adjustments are tied to national inflation data. They are not designed to keep up with local tax changes or housing markets.

In practical terms, that means income tends to move gradually, while property taxes can move abruptly. Over time, even modest tax increases can narrow the margin in a household budget, particularly for homeowners who want to remain in their homes long term.

This is one of the reasons property taxes deserve attention even when the home is paid off.

Do Property Taxes Ever End for Seniors?

Many homeowners ask whether property taxes stop at a certain age. In most places, they do not. Taxes remain due as long as the home is owned.

What does exist are relief programs. These programs vary widely by state and county, and they often come with eligibility requirements related to age, income, or length of residency. The important detail is that relief usually requires an application. If no application is filed, the tax bill stays the same.

The most common forms of relief include homestead exemptions, assessment freezes, income-based credits, and deferral programs.

Understanding the Main Relief Options

Homestead exemptions reduce the portion of a home’s value that is subject to tax. Many states offer additional exemptions for older homeowners. These reductions are often modest on paper but meaningful over time.

Assessment freeze programs work differently. Once a homeowner qualifies, the taxable value of the home is locked in. Even if market values rise, the assessment used for tax purposes stays the same. This does not eliminate taxes, but it limits future increases.

Tax deferral programs allow seniors to postpone paying property taxes until the home is sold or transferred. This can improve short-term cash flow, but deferred taxes usually accrue interest and become a lien on the property. This option should be considered carefully, especially when estate planning is involved.

Some states also offer income-based programs that limit property taxes to a percentage of household income. These are often referred to as “circuit breaker” programs and are designed to prevent taxes from becoming unmanageable for lower-income retirees.

Why Budgeting Still Matters

Even with exemptions or freezes in place, property taxes remain an ongoing obligation. From a planning standpoint, the goal is not to eliminate the expense but to make it predictable.

One of the simplest and most effective strategies is to treat property taxes as a monthly cost, even if they are only paid once or twice a year. Setting aside a portion each month prevents large bills from disrupting cash flow.

It is also important to review assessment notices carefully. Mistakes do occur, and homeowners generally have the right to appeal an assessment they believe is inaccurate. Many people ignore these notices, assuming nothing can be done. That assumption can be costly over time.

Aging in Place Is a Financial Commitment

Remaining in one’s home provides stability and familiarity, which are valuable. But aging in place also means accepting responsibility for expenses that do not disappear with retirement.

Property taxes, insurance, maintenance, and healthcare costs all change over time. The homeowners who manage this transition best are usually those who plan conservatively, review their expenses regularly, and avoid assuming that today’s costs will remain unchanged.

This approach does not require constant attention. It requires periodic review and a willingness to adjust.

Staying Ahead of the Issue

Property taxes are not usually the reason people have to leave their homes, but they are often part of the picture. When they are ignored, they add pressure. When they are planned for, they become manageable.

Aging in place works best when financial decisions are grounded in realistic expectations. Budgeting for property taxes is part of that realism. It allows homeowners to stay in control of their finances and remain in their homes with fewer surprises along the way.